Covid-19 has accelerated bank closures but also fintech developments across all regions in Western Europe and the US. The pandemic has changed how people bank – it might not be (yet) permanent but the crisis is an accelerator for fintech trends like mobile-only banks. This excerpt is part of our client-exclusive Digital Dossiers at Wildstyle Network.

Covid-19 has accelerated bank closures but also fintech developments across all regions in Western Europe and the US. The pandemic has changed how people bank – it might not be (yet) permanent but the crisis is an accelerator for fintech trends like mobile-only banks. This fintech trend dossier is part of our client-exclusive Digital Dossiers at Wildstyle Network.

What is a challenger bank?

Challenger banks are tech companies. They leverage software to innovate, digitize and streamline retail banking. Challengers use digital distribution channels, typically mobile, to offer competitive retail banking services such as checking and savings accounts, loans, insurance, and credit cards. Well, that’s where these fintechs started with their business models.

Let’s take a look at the fintech trends, especially at the state of those who challenge the status quo and the traditional way of banking. Specifically, why they’re continuing to gain traction, how they’re expanding product sets beyond debit cards and digital accounts, and why they’re a threat and an example to traditional banks.

Traditional banks are not sleeping behind the wheel. They’re already responding. By mimicking the digital, structural, and behavioral trends of today’s challenger banks. This paves the way for an end of cash. It has never been closer.

The impacts COVID-19 has on the challenger and traditional banking sector

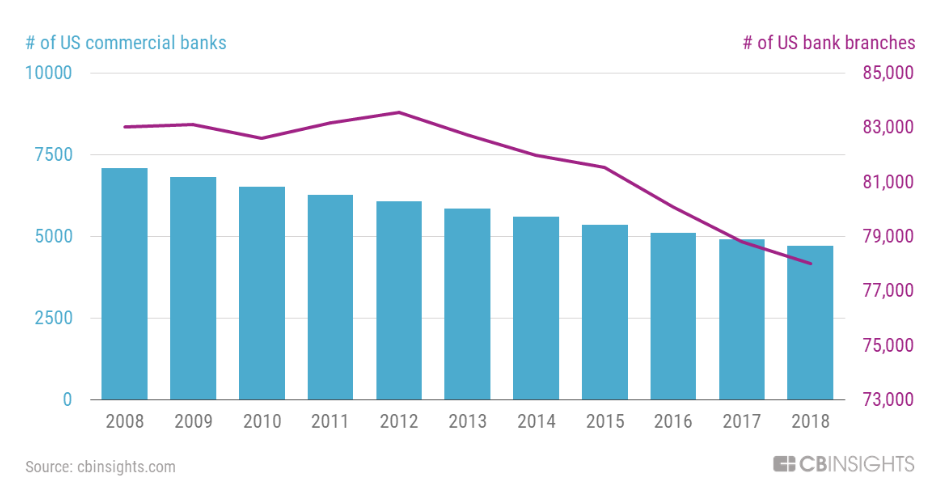

Within the banking sector, COVID-19 has accelerated bank branch closures propelling, a trend that started over a decade ago. Some of the largest U.S. banks have reevaluated the branch footprints as consumers and small businesses become more attracted to digital and mobile banking.

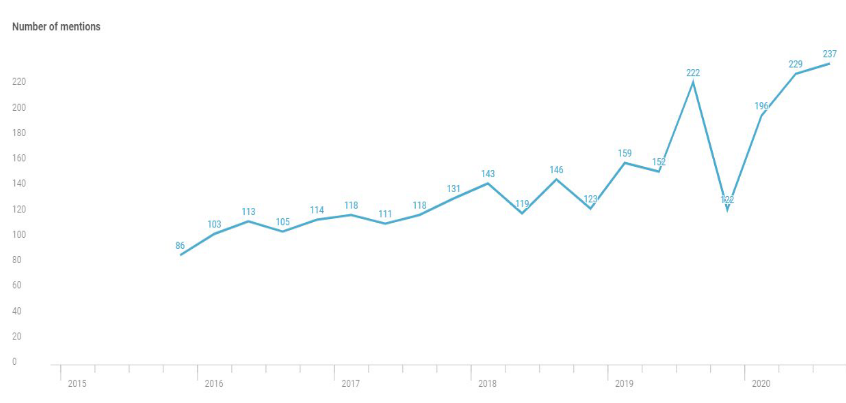

Source: CB Insights, analytics of earning calls between 2015 and 2020

In recent months we’ve seen a number of announcements from major US banks – around expediting their branch closures and rationalizing their national footprints.

While there’s undoubtedly a role for branches to play in banking going forward, experts expect that this trend is only going to continue to accelerate.

So as a result of the pandemic and the related lockdowns, mobile has really become the default banking channel for consumers and small businesses. As expected, digital and mobile banking are top priorities for C-suite executives, in both, existing analog banking customers to digital ones.

Responsible Banking becomes sweet spot for traditional banks

However, some traditional banks are answering the threat of challenger banks by showing that Responsible banking is more important than ever. They’re supporting their customers through the crisis, both in their role transmitting government stimulus measures, offering forbearance and emergency funding to clients and donating to relief efforts.

Banks must remain aware of the reputational risk they face where customers feel they don’t get the support they need. Neverthless, COVID-19 doesn’t slow down the digital transformation and innovation process of traditional banks.

Digital customers are important for a couple of reasons

Digital customers are more engaged and they’re often cheaper to serve. Beyond that, they provide a seamless platform to cross-sell additional products to customers. Similar to the acceleration that we’ve seen in e-commerce and retail, the shift to digital and mobile banking has continued to persist throughout the year.

Bank account opening is bouncing back

(Update) After a slump during the pandemic digital account opening (DAO) activity, in particular, is poised to benefit from the surge. But as banks work to optimize their DAO processes, they will face stiff competition from neobanks and Big Tech companies; both are raising the bar for DAO and count millions of customers among their existing client bases.

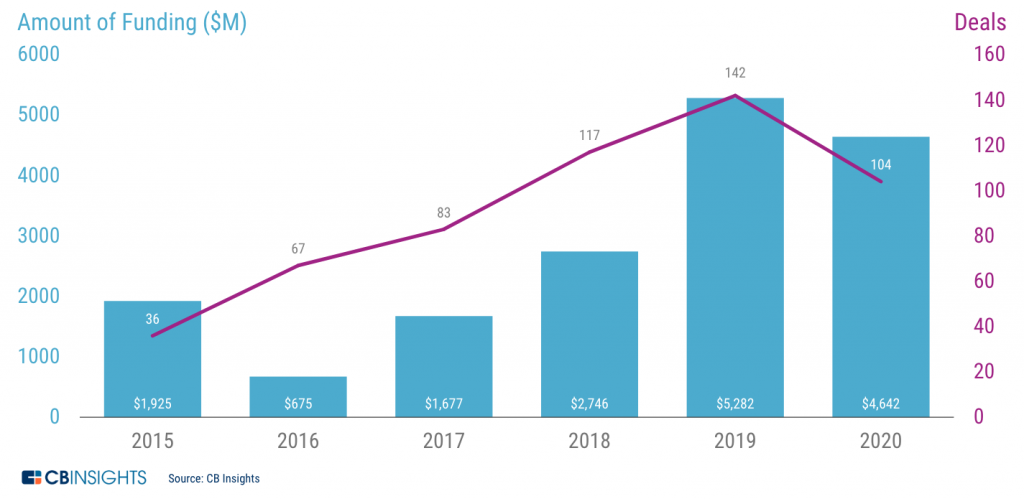

Founding rounds of challenger banks accelerate the shift to mobile banking and also to new services

Venture backed challenger banks have been a major beneficiary of the continued shift to mobile. They’re also obviously a catalyst for the continued adoption in the US and globally. This year, challenger banks have continued to lure-in funding following a record year in 2019.

We’ve seen some later stage mega-rounds this year from companies that many of you are probably familiar with: Chime, SoFi, and Vala. All of whom are dialed in on continuing customer growth while expanding into new products.

Catalysts for growth in the digital banking industry and the under-banked population

The initial entry point for challenger banks was a no-fee offering that is matching with the expectations of an under-banked population. This is a similar dynamic across consumer FinTech. But for incumbent banks, there’s a threshold of a customer below although these users are not necessarily the most profitable customers.

Consumer FinTechs have honed in on this niche to provide a better product in a digital fashion and also benefit from lower overhead costs.

Because if you think about retail banking, operating cost structures, especially the branch networks can account for up to 30% of costs.

That being said, they have a lot more room to work with on the margin side. Fee income and retail banking, which really means service charges, overdraft fees, and insufficient fund fees, have risen over the past two decades.

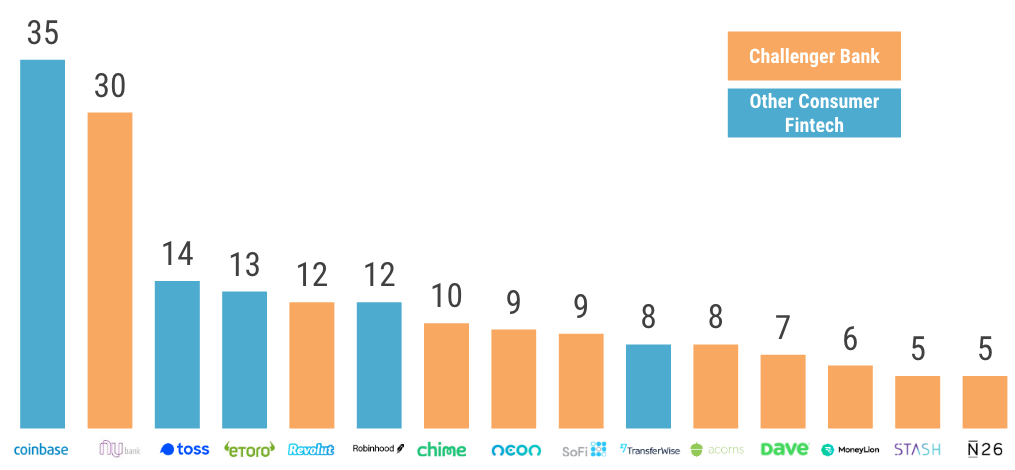

Source: CB Insights

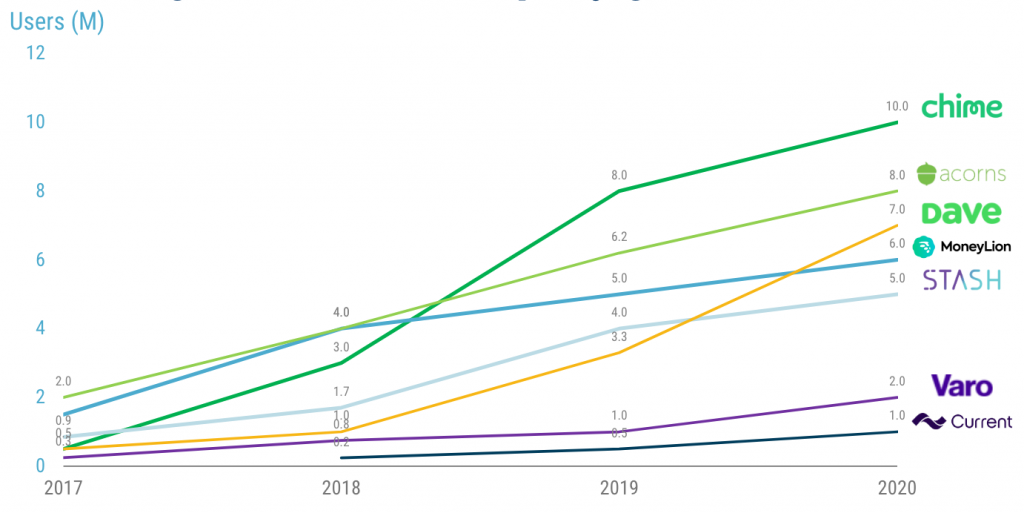

Starting point for challenger banks: Consumer FinTechs have scaled their user bases by starting with an initial core compelling product offering. Many of these companies have grown their user base rapidly over the past couple of years.

Neobanks are becoming the primary bank

Chime, a San Francisco based challenger bank in the U.S. is the largest. The last publicly announced number was 10 million users. To compare this to Europe’s rival N26: The company announced in 2020 that it now serves 5 million customers globally.

What’s interesting is some of the largest challenger banks have really established themselves as viable competitors to the incumbent banks. This also means that…

So it really reflects that there is a product-market fit here.

Neobanks struggle against a common existential threat: profitability

Here are some of the different strategies they’re taking to turn a profit:

- Freemium pricing strategy. Some neobanks offer their product for free but charge for additional features: Australian neobank Douugh uses a freemium model, in which the free account helps with budgeting and the premium account analyzes a user’s finances and helps them invest their money.

- Multitiered premium subscriptions. UK-based neobank Revolut operates this model: Its basic account is free, while its premium account costs $9.99 per month, and its top tier ‘Metal’ account costs $14.99 per month.

- Targeting niche demographics. Australian neobank Judo specifically targets small- and medium-sized businesses with their loan provisions

Multiline product strategy becomes the goal in 2021

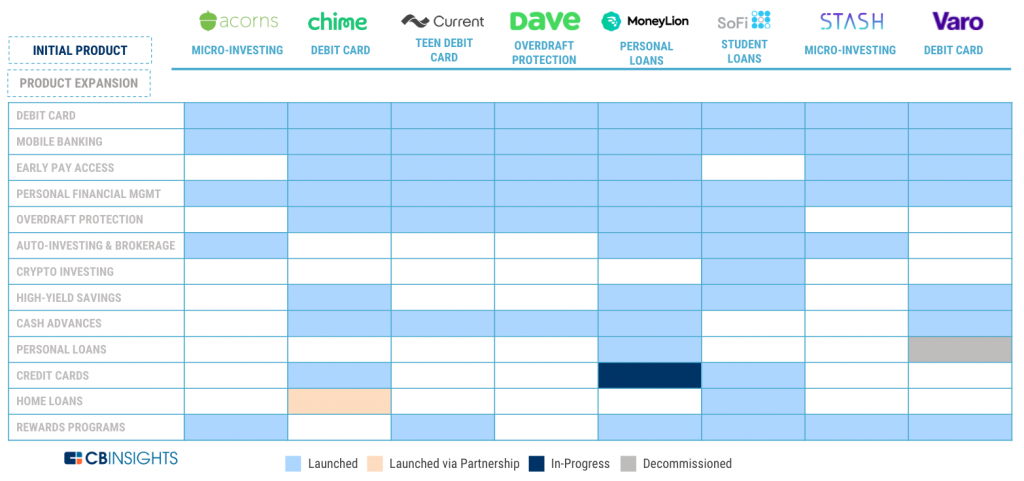

The next fintech trend we’re going to check in our digital dossier is the shift from a mono-line to a multi-line product strategy. A number of the largest consumer fintech companies in the US started with an initial digital product where banking startups have been establishing a viable user base and a durable revenue model.

The common starting point has been the debit card because it provides a high volume revenue model that helps to drive a recurring relationship with customers. The expansion into consumer credit is the kind of tertiary products linked to their core debit and digital account offerings.

However, the consumer credit lines are just the starter. We’re further seeing personal loans, brokering, brokerage, and digital wealth.

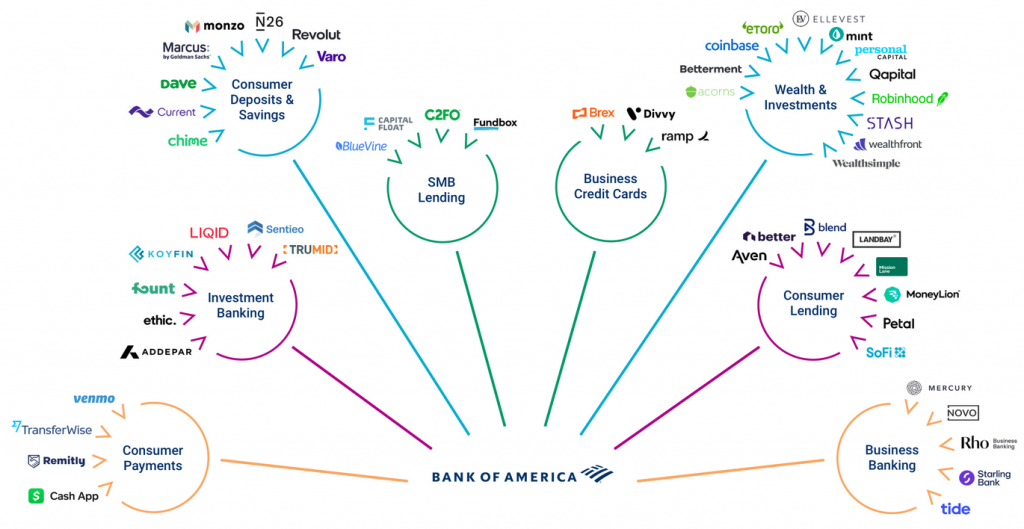

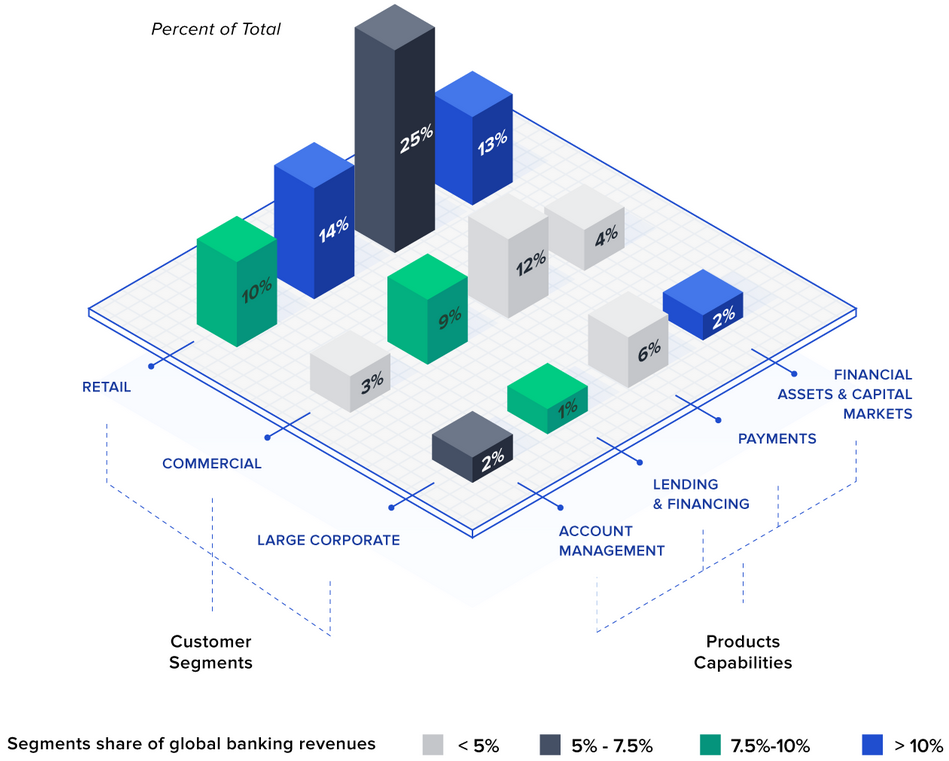

So far, fintech startups have not looked at the widespread disruption of all financial services. McKinsey’s analysis of a sample of startup data shows that 62% of startups are tackling the retail banking segment, with only 11% focused on large corporate banking offerings. Payments are the most popular area and lending is the most lucrative area of banking by revenue being targeted:

As you can see, not all segments are being disrupted yet. Payments and lending/financing still remain the focus of challenger banks.

Partnering with Banking-as-a-Service providers – a fintech trend for emerging startups

Banking-as-a-Service has become THE dynamic solution in fintech to digitally deliver a customer-centric, bank platform into the market quickly. BaaS providers have been able to provide a banking infrastructure through APIs (application programming interfaces) that can be implemented and launched in months without monetary licenses (for most use cases) or large rounds of capital.

Fintech startup Stripe has announced an ambitious new product called Stripe Treasury. The company is partnering with banks to offer a banking-as-a-service API. In other words, Stripe clients will be able to provide bank accounts to their customers — the service is invite-only for now.

This is part of a bigger fintech trend called embedded finance. Essentially, instead of separating banking services from other services that you use, embedded finance products provide financial services as close as possible to the end customer in the services that they already use.

For example, Shopify will use Stripe Treasury for Shopify Balance. If a Shopify merchant wants to hold money, pay bills, and spend money from their Shopify account, they can open a bank account in Shopify Balance directly. This way, Stripe’s customers can skip the traditional bank account. Behind the scenes, Stripe Treasury powers that feature.

Traditional banks that sensed the upcoming trend of Banking-as-a-Service opened up their banking capabilities to other fintech players through APIs. For these Banks with BaaS, the banking-as-a-service capability helps create a hedge against tech competition and builds deposit share in wider market segments.

Europe’s PSD2 requires banks to offer at least one interface: Challenger banks can offer a suite of services with more engagement than full-service banks

PSD2 was a landmark and introduced in November 2015. With established standards for an ecosystem of regulation, infrastructure, and authorizations favoring 3rd-parties, there were no early barriers to open banking.

PSD2 has helped lot of the challenger banks to incorporated ad-ons and supplementary products to convince customers to link their direct deposit account to this challenger bank account.

So the next step of this digital fintech dossier here is around product expansion and how fintechs are adding additional products to deepen engagement while diversifying revenue and amplifying customer relationships by offering a suite of products that helps to present themselves as a viable alternative to a full-service bank.

Banking-as-a-Service trends in 2021

The future of BaaS will be a much more mature, refined, and optimized version of what we see today. Overall, the Banking-as-a-Service sector will achieve mainstream adoption in the next decade as consumers demand the best from financial services providers.

The definition of BaaS will be split into multiple subcategories with new market entrants, especially large tech giants that have been standing on the sidelines. In the next few years, the industry will grow to become transparent as firms and regulators will work together to bring all banking services via API.

This enhanced model of banking will push out banking services to apps and other pieces of software. Consumers no longer need to go to a bank OR talk to a person (due to AI-enabled bots) to complete any banking activity. The absence of the “human touch” will dramatically change a primary banking relationship as users can quickly switch their banking to new companies that deliver on individual financial wellness goals, such as long-term wealth and debt management.