This has been a turbulent year on many fronts in the FinTech trend research space. From the sustained pandemic outbreak to a war-induced energy crisis and the crypto market crash, constantly adapting to changes has become the new normal for businesses around the globe. And while most digital verticals are beginning to suffer under a financial crisis, some FinTech trends are already building resilience strategies.

This compendium here is the successor of 2021’s FinTech Trend Dossier.

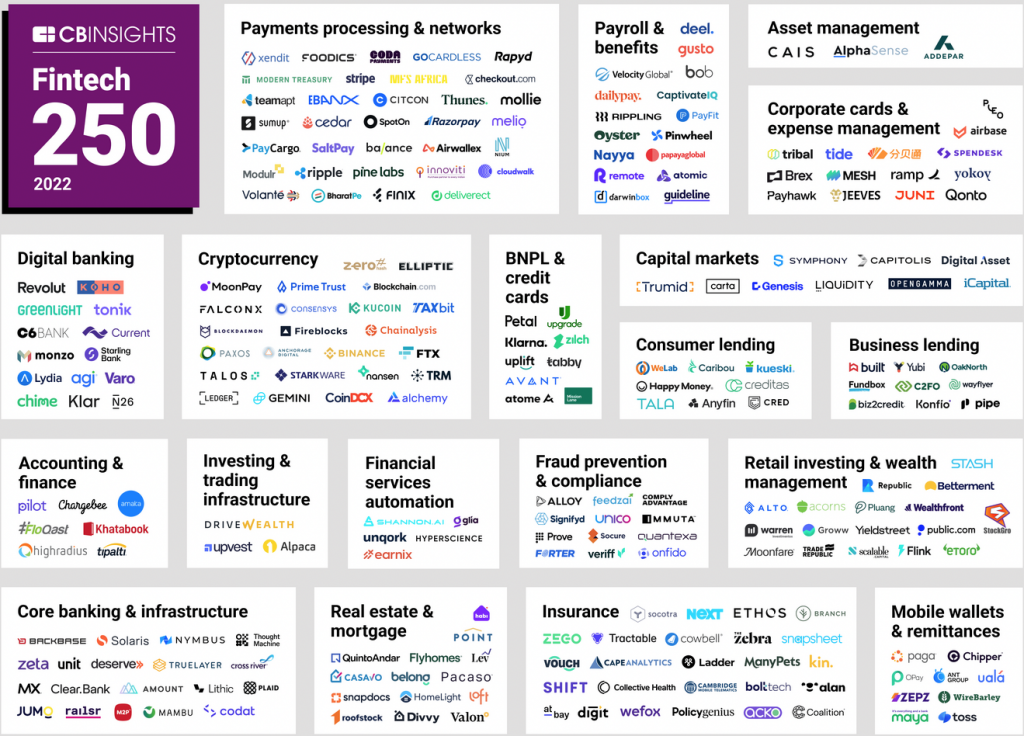

The latest FinTech trends in 2022 and 2023, the leaders’ list, are dominated by payments processing and networks, insurance, and believe it or not cryptocurrency, followed by FinTech trends in the corporate cards and the expense management space. Of course, Apple Pay plays a disruptive role as well as what’s happing in the emerging markets.

So let’s start with the most underwhelming news:

The fintech trends dossier’s relevant set is also defended by long-time winners in the core banking infrastructure, retail investing, and wealth management space. Nothing new here.

When looking at the equity funding from all 250 FinTechs that are listed in the latest CB Insights market map, there’s been over $70 billion in funding to these winners since the start of 2021. Why is this important? Well, with the current turmoil that is going on in venture land, the FinTech space stays relatively strong in Q2 and Q3 2022 – compared to other industry verticals.

However, talking about the last seven months, there’s going to be a decline by the end of 2022 or the beginning of 2023 in funding to these 250 FinTechs.

The number of deals through the nine months of this year will be lower than the full year of 2021. This decline is very much in line with the rest of the FinTech industry, and really venture capital at large.

So far this year, there’s been 30 new unicorns among the top250 this year.

To put this in context: There are almost 300 FinTech unicorns in the world. Maybe that number of 30 new black swans isn’t that outrageous.

One FinTech Trend: Leaders are familiar Faces

Nearly two-thirds of this year’s leading FinTechs are familiar faces with a majority of 64% of winners are primarily b2b. The global representation of these leading FinTech trend leaders come from 33 countries is the most ever that the industry had so far.

(PICTURE COUNTRIES)

The US and Europe have long been the centers of innovation and technological advancement. In the world of fintech, this is no different. The US has 132 unicorns in the fintech space, while Germany and France only have 6 and 7. So, what is behind this discrepancy? What makes Europe such a fertile ground for fintech startups? And why are American startups so successful? Is it access to capital, regulatory environment, and talent pool?

The US has a clear advantage when it comes to accessing capital. In 2019, American fintech startups raised a total of $32 billion from venture capitalists. This is more than double the amount raised by their European counterparts ($15 billion). The US also benefits from a more favourable regulatory environment. The Securities and Exchange Commission (SEC) has been very supportive of fintech innovation, while European regulators have been much more cautious.

Why FinTech Trend Leaders stay Leaders

One reason is that the FinTech market is maturing. A good number of the leaders are nearly a decade old. Many have already found product market fit. These FinTech leaders are also staying private for longer.

This maturity means that the fintech landscape is changing. Private companies are no longer the only players in the space. Traditional financial institutions have entered the fray for 2-3 years now, with many of them investing in new FinTech startups or launching their own (neo)products and services.

This increased competition is good for consumers, as it drives innovation and forces companies to offer better products and services. It also means that fintech companies need to be on their game if they want to stay ahead of the curve.

In previous years, we’ve seen IPOs and M&A exits, which would remove companies from being eligible. That didn’t happen in 2022. Very much because of the state of public markets. This trend in FinTech seems to get to a halt.

FinTech Trend Categories with Growth

Payment processing and networks are likely to stay and win new market shares.

So this category of payments, includes payments, acceptance and checkout solutions – with Stripe really being the market leader here. We also see new entrants for payment solutions for the Point of Sale and vertical-as-payments for health care for logistics for restaurants.

New Startups stay away from FinTech

The macroeconomic pressures in form of slumping public markets, inflation, interest rate hikes etc. are simply inhibiting new entrants from making a splash growing and taking away market shares from those top leaders. The result: The growth of new FinTech startups has been slowed down.

This is good news for FinTech trend leaders and for the traditional financial industry which is still fighting to keep up with the FinTech trends and the neobanks’ simplified user experiences, the real-time brokerage and modern interface designs. Even though established companies have started to embrace some aspects of fintech, they are still struggling to catch up. This provides an opportunity for fintech startups to gain market share.

However, given the current macroeconomic conditions, it is unlikely that we will see a wave of new fintech startups in the near future. This is bad news for consumers who would benefit from the competition, but it is good news for the fintech companies that are already established.

Our prediction: The top250 leaders in FinTech have a very good chance to stay leaders for the next two to three years.

Now let’s see the latest FinTech trends and who’s breaking out and why.

Globalization: The Remittance Industry, Checkout.com and Paga

The globalization theme in FinTech really stood out for us. Especially the idea of localization or certain local markets and regions. And that’s been a strong focus for winners in emerging markets: Mobile payments in Africa, digital banking in Brazil, payment acceptance in India – just to mention a few competitive FinTech trends in emerging markets where big players will see blockers for growth.

Checkout.com and Molly show how they’re competing with the bigger players like Stripe and Adyen. They are scoring with a nine out of 10 customer satisfaction score.

While Checkout.com revealed strength in emerging markets in the Middle East in particular, and competitive pricing against giants like Stripe, Molly provides ideal support for midsize businesses and startups that have a strong focus in Europe and especially the Netherlands. Both have easy integrations.

According to software architects and developers in the space, the software integration of Checkout.com is already as easy as implementing Stripe’s APIs.

The other truth is that Checkout.com is still hardening its technology and operations. While there’s a general satisfaction, we’ve heard from startups that got into serious financial trouble with Checkout.com’s pricing and billing model where higher fees were charged and not returned.

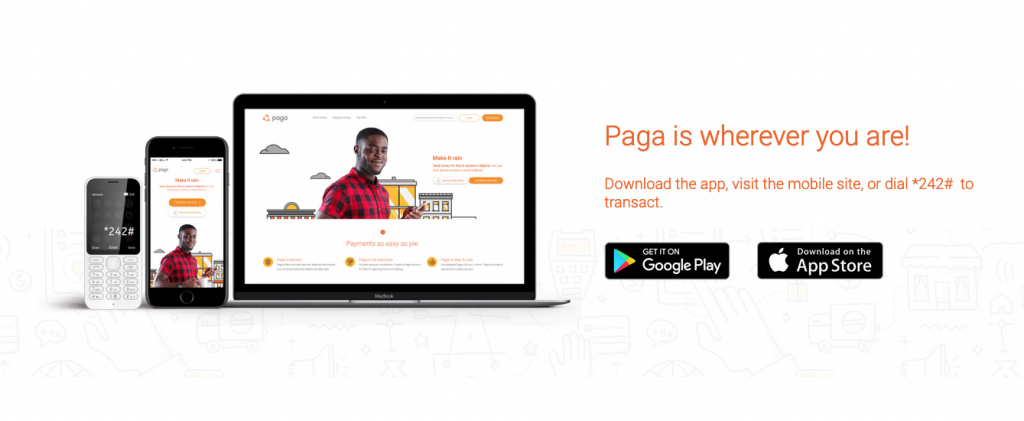

Another notable startup here is Paga. The company is a mobile payments provider in Nigeria with over 19 million unique users. They offer p2p payments, remittances, bill pay to anyone with a phone number or an email address. They are running a $0 fee policy on money transfers within a network of 27,000 agents. They’re integrated with 200+ utility and service providers for bill pay. Their partnership with Visa allows users to link Paga accounts with Visa cards.

Paga’s business model goes along with stronger regulation in emerging territories.

In October 2022, the government blocked millions of phones and want citizens to register their phones with their ID, fulfilling its almost two-year-old promise to cut off non-compliant citizens.

Such regulations will have an impact on the remittance business that relies on cell reception and SIM cards. Africa is having a 44% mobile penetration rate. SIM cards are one of the most ubiquitous technologies around.

The legal void around government handling of data might become a blocker for growth. Every startup is well advised to get their governance in good shape.

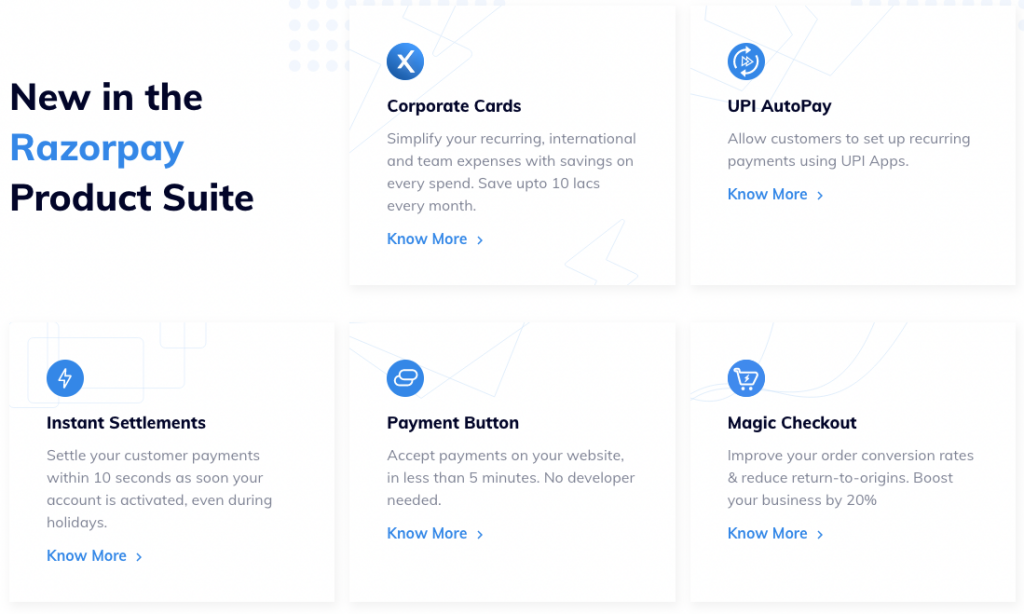

Just a few time zones to the east, Razorpay already provides a payment gateway for over 5 million businesses in India. Razorpay seems to become the Stripe of India. With payments acceptance for over 100 payment methods, business banking products in corporate cards as well.

Corporate Cards and Expense Management

This is a new standalone FinTech trend category this year. These companies were rolled up into a broader business finance category really showing the growth of the industry. That’s why we decided to break it out into its own category.

We’re fans of Germany-based Pleo and their corporate credit card (note: we’re not a customer yet).

However, the entire space sees more aggressive growth and ad spend in the past months. With more employees traveling this year, these expanse management systems are a vital part of some companies’ digital transformation efforts since they’re moving expense management over to their employees.

Insurance Category merges with Cyber Security

Other winners in the FinTech top250 list are focused on small and medium-sized businesses. With insurance startups selling products directly to customers. That could be consumers, individuals, or businesses.

This category also includes the companies that sell technology to reinsurers and insurance brokers. This combination of cyber security and insurance is called “active insurance”. Combining insurance with cyber risk management, monitoring, and incident response creates a customer base of over 160,000 for Coalition, a startup valued at $5bn and founded in 2017 in San Francisco. They already secured partnerships with some of the biggest insurance providers like the German Allianz Group or Lloyd’s of London.

Crypto is maturing

Yes, crypto. In the crypto space there are still lots of winners. Despite the crypto market downturn happening this year, this category still includes crypto exchanges, custody providers, prime brokerages, crypto compliances & transaction monitoring, infrastructure providers, and, a growing category called crypto-as-a-service (I wonder why it took so long to establish such services).

On the other hand, the number of “losers” is increasing. We have already seen a significant number of projects either close down or exit scam this year. This is not surprising given the current market conditions but it does show that the industry is still very much in its early stages and is yet to see widespread adoption.

What is also interesting to see is that, despite the bear market, there are still a number of startups that are managing to raise significant amounts of funding. This just shows that there is still a lot of interest in the space and that people are willing to invest in projects that they believe have long-term potential.

One such project is Solana, which recently raised $20 million in a Series A funding round. Solana is a project that is working on creating a scalable blockchain platform. The project has already seen some success, with a number of high-profile partnerships and projects built on top of its platform.

So, while the crypto market may be down at the moment, it is still very much in its early stages. There are still a lot of opportunities for those who are willing to take the risk and invest in projects with long-term potential. And, as we have seen with Solana, even in a bear market, there are still some startups that are managing to raise significant amounts of funding.

The crypto space is actually tied with the payments processing and networks category. These deep connections will also create dependencies.

However, while the crypto industry at large is slumping and markets are down, we’ve actually seen some indicators of longer-term momentum: The funding, investors support, the number of customers, and the partnerships they established with some of the biggest financial institutions in the world.

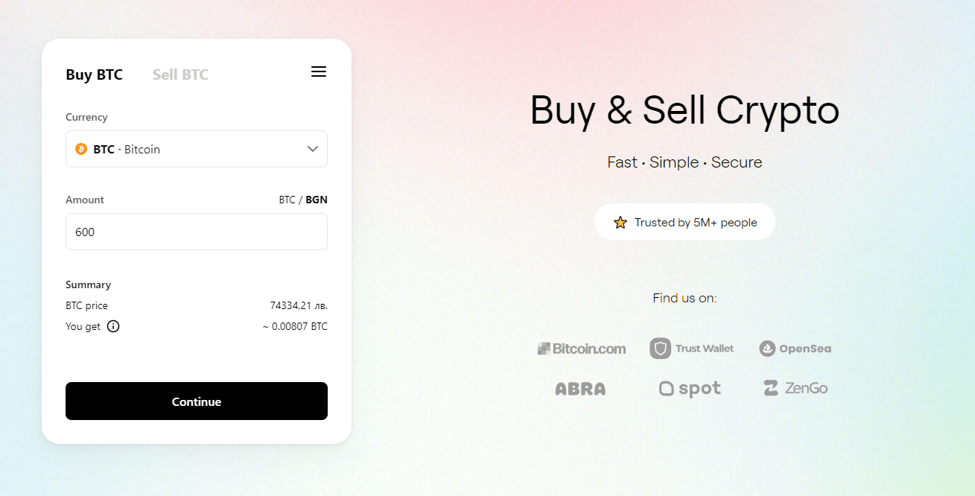

One startup that we want to highlight is MoonPay which provides Fiat on-and-off-ramps for companies offering crypto and NFT products. So with MoonPay crypto businesses can convert Fiat to crypto and vice versa, and accept payments from all the major payment methods such as MasterCard, Visa, Apple pay Google Pay, and even bank payments. They already support 80+ cryptocurrencies and 40+ fiat currencies.

With MoonPay customer doesn’t already have to own crypto in order to trade for other cryptocurrencies or purchasing an NFT which is really a real pain point. The process of buying NFTs is slowing down customer adoption and onboarding. This is probably why their valuation jumped after a $Series A (A!) funding round to a whopping$3.4bn valuation.

Apple is the latest Industry Shocker, and this is just the Beginning

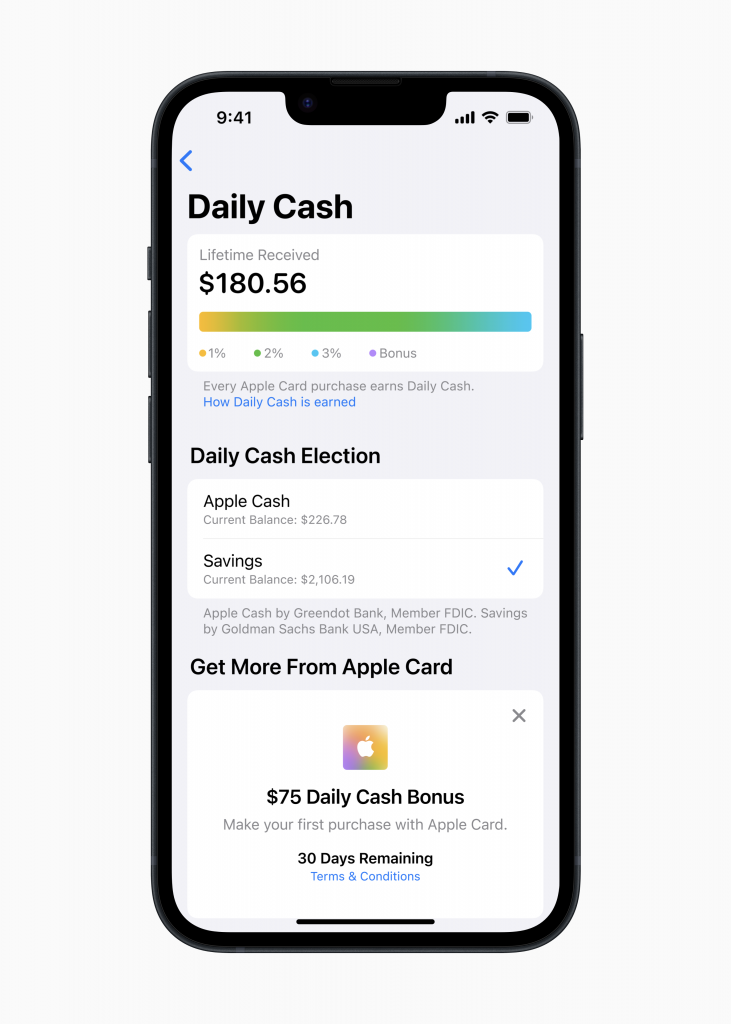

Although Apple is holding only money transmitter licences which limits Apple to run full banking services, Apple is disruptively changing the banking industry again. With the release of their new payment system, Apple Pay. In this new UX and interface design driven environment users can add money to their Savings account by transferring money from a linked bank account or from their Apple Cash balance.

They can also withdraw their funds at any time by transferring them to a connected bank account or to their Apple Cash card, with no fees. This will force most consumer-facing banks to match this offer or face the wrath of Apple’s disruption. Tap To Pay and Apple Pay Later are two more features that banks and payment gateway providers will not like. But users can set it up right from their iPhones without going to a bank or even filling out a bunch of paperwork.

Users can add more money to their Savings account by transferring money from a linked bank account or from their Apple Cash balance. And they can also withdraw their funds at any time by transferring them to a connected bank account or to their Apple Cash card, with no fees.

“Savings enables Apple Card users to grow their Daily Cash rewards over time, while also saving for the future.”

If it looks like a bank, acts like a bank, what is it?

Quote comes fro Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet .

In the same way that Apple disrupted the music industry with iTunes, they are now looking to disrupt banking. And they are doing it with Apple Pay.

So why would a first-time Gen Z banking account customer think of going to a banking branch to sign-up for an account with paperwork and dozens of signatures if the iPhone that they carry in their pocket, love, and trust could be their bank?

Payroll and Benefits Startups

Here we’re talking about payroll platforms, APIs, HR benefits, performance management, recruiting, hiring, onboarding, and off-boarding.

A major driver is that these startups are now expanding their product offerings by providing all-in-one platforms.

One of those companies is Rippling. If you think about the idea of super apps, kind of a hot topic in FinTech recently, and if you think of startups with a consumer focus, so-called super apps, then Rippling is developing such a super app for the workforce. They offer payroll benefits, talent management, IT management, build, pay, and most recently added, spend management and corporate cards. Offering all this through one platform.

While Rippling had little over a $1 billion valuation in 2020, they’re having raised two funding rounds in the last year at an $11 billion valuation.

B2B is the new trend in FinTech

64% of the FinTech 250 are primarily B2B and in the US, 99% of businesses are small. That could mark a pretty big FinTech trend to create solutions specifically for small businesses.

FinTech has historically been seen as a disruptor and a fighter against traditional financial services.

We strongly tend to say that this is not entirely true anymore. We’re seeing the industry, working with and working for traditional financial services, providing them with technology solutions for digital transformation. Thinking of categories like core banking and infrastructure, asset management, tech capital markets.

The B2B and B2C Split

It represents a broader shift in market sentiment away from the consumer-facing in tech. So multiple reports have come out this year, citing the lack of profitability of consumer-facing FinTechs, mainly neobanks. The FinTech Trend Dossier 2021 (Link) already reported how N26 and Revolut are fighting for profitability. Robin Hood and Coinbase have struggled this year.

There’s plenty of B2C FinTechs within the top250. Nevertheless, we are seeing a bit of a shift in confidence away from the b2c FinTechs this year.

Core Banking and Infrastructure

It’s the fourth largest category for the second year in a row with 19 companies within the top250 list. These companies are providing behind-th- scenes processing of deposits, payments, and lending. Open banking, banking-as-a-service providers are included here too.

Thought Machine (thoughtmachine.net), which provides a cloud-native core banking platform. Their platform is called “Vault” and it runs on Microsoft, Azure, AWS, Google Cloud, you name it, and it offers over 200 pre-configured financial products with all data running in real-time within the system.

Why is it important? Well, thinking about migrating core banking to the cloud brings cost savings, and increased security reduction in carbon footprint. Their clients are banking corps such as ING, SEB, Lloyd’s, and Standard Chartered

With providers like Thought Machine, the cloud provides a faster, easier way to launch financial products. The London-based venture was founded in 2014 and has raised (only) $508m to date (according to Crunchbase). They’re valued at $2.7B in 2022.

Fraud Prevention and Compliance

This category sees growing importance because fraud is (still) on the rise. A recent study by KPMG found that 71% of business executives in the US and the Americas experienced fraud in the last year.

Here we’d like to highlight the KYC startup Veriff which was already founded in 2015. They provide identity verification, AML screening, and biometric authentication. This verifies identity by capturing someone’s face on their phone) They’re now approaching a 98% check automation rate. Their customers are companies where identity is key for their business model: Trustpilot, Blockchain.com, and Bolt.

Everyone who’s been experiencing this minute-long process with other providers can imagine why Veriff is valued at $15B. Veriff’s average verification speed is 6 (!) seconds, really incredible.

Spend, Account and Expense Management

More insight into spend management and how that’s evolving? Well, corporate cards and expense management is breaking out as a “new” category.

Startup Ramp was here the top score for customer satisfaction and spend management.

These platforms are expanding their products to an all-in-one spend management platform with other products like accounting,

Rippling and Razorpay starting to offer corporate spend management and corporate credit cards as well.

It seems that this category is becoming a subcategory by moving under the roof of B2B Fintechs.

BNPL Regulations and Globalization

This space was and still is in the news. We see some struggles and valuation cuts as well as layoffs among big players like Klarna. Our main question is, is that space going to be regulated soon? The voices around a regulation get louder – with the U.S. Consumer Financial Protection Bureau (CFPB) suggesting that companies like Klarna and Afterpay, which allow customers to pay for products and services in installments, must be subjected to stricter oversight.

The CFPB said that it found BNPL vendors are approving more customers for loans — 73% in 2021 compared with 69% in 2020 — and that delinquencies on these services are rising sharply.

If the writings on the wall get thicker, the BPNL space will see fewer market entrants and probably a consolidation. At the same time, the Klarnas and Afterpays need a globalization path in territories that are not yet seeing restrictions.

We think, from that point of view, it’s definitely a little bit of a wait-and-see.

ESG will accelerate FinTech startups

There will likely be a growing increasing interest in FinTechs with ESG capabilities, given the prioritization of ESG happening more broadly. This will include companies focused on climate change, decarbonization, and the circular economy.

Personal Finance

You probably scrolled down here because you’ve already missed the Personal Finance startups? Well, it used to be budgeting tool in credit score products. Most of these features and services are now an integral part in digital banks, retail investing and wealth management platforms.

DeFi-ing FinTech Trends

Web3 might feel like clickbait at times. The reality is, it has the potential to shape the future of internet experiences, from e-commerce to social media to gaming, to… Fintech!

The decentralized nature of Web3 is what makes it useful and powerful.

We’re already seeing some ideas manifest in decentralized finance (DeFi). DeFi refers to an ecosystem of smart contracts that allow participants to offer and access financial services in peer-to-peer formats. Without relying on intermediaries like the traditional banking ecosystem.

This massively shifts dynamics of how we interact with financial services. DeFi protocols are not only creating new financial services, like crypto trading and NFT lending, but also disrupting things we already do, like payments, investing, and even insurance.

Two notable startups here are Uniswap and Pancake Swap.

Decentralized exchange platform Uniswap just hit unicorn status last week and sees $1T (to make sure: one trillion) in trading volume since its founding in 2018.

DeFi app Pancake Swap counted 2.4M users in the month of June 2022 alone.

These startups deliver on the promise of Web3, a decentralized internet built on an open, permissionless blockchain network.

Last but least: When looking at 2021’s FinTech Trend Dossier, we should also mention the forgotten Fintech trends. Those which promised a new land but have not delivered a sustaining trend for the ecosystem: Multi-line product strategies (not fully delivered as foreseen), profitability for Neobanks, Neobanks becoming the primary bank, responsible banking.

The FinTech Trend Dossier 2021 has delivered on the other mentioned trends such as Banking-as-a-Service, the liaison between traditional banks and FinTech banking APIs, founding rounds in FinTech, and the “underbanked population” in emerging markets.

Now let’s meet again in 2023 and see which FinTech trends are sustainable and which new FinTech trends are emerging.

About the author: Wildstyle Network has a long history of designing and developing digital ecosystems for the fintech industry. Our digital experience platform helps neobanks and traditional banking institutions to launch new products and digital environments faster.